Commercial insurance benefits

Background

When confronted with a behavioral health condition, individuals and families learn quickly that commercial insurance covers acute care (like hospitalization) but does not support individuals over the long term.

This is a particularly hard situation for those with psychotic conditions. Insurers have consistently denied that integral components of care, such as school and job supports, as not “medically necessary.”

Families and individuals may feel like they are “through the looking glass” like Alice in Wonderland, trying to get access to what is needed.

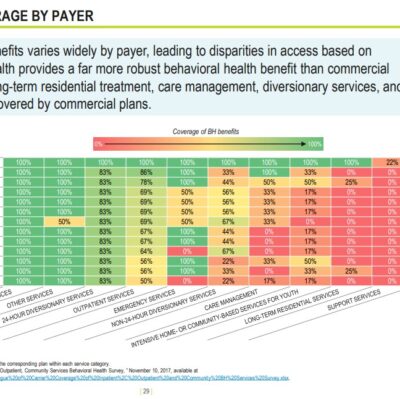

A Blue Cross Blue Shield of Massachusetts Foundation of Massachusetts Behavioral Health System report (2020) graphically shows that folks with chronic conditions end up on MassHealth and Medicaid because insurance doesn’t pay for what’s needed. [Image on this page is slide 29 of the report].

For Coordinated Specialty Care and PACT this means that many programs attempt to provide services billing fee-for-service (FFS) for whatever they can. Clinical care visits like a psychiatrist and social worker can be reimbursed this way. But integral parts of these programs that are the basis of the research that shows THEY WORK, are not included. Programs may require participants to pay out of pocket, seek grants or not provide these key components like peer support, job support and school support.

In this way, insurance companies require that services be “evidenced based” while simultaneously refusing to pay for key components of the system design that provided the evidence. Then, they are likely to turn around and say it doesn’t work!

It is a decades-long business practice of commercial insurance companies to deny this coverage and they have successfully pushed individuals needing care onto the Medicaid system (which is at the taxpayer’s expense). Tragically, this often happens years into needing help and folks are much more ill than had they received all the care at the outset.

Insurance typically covers acute care like hospitalization. Historically, that has meant that individuals with severe mental illness (SMI) end up cycling in and out of hospitals. Research shows this is very bad for the individual. And ironically, it’s actually not cost effective either. The resistance to paying for programs like PACT has been that wraparound services are not “medically necessary.” And also typically in the past, insurers could avoid this type of care by not covering this population.

That’s not the case anymore. A combination of the ACA’s provision that children stay on their parents plan until age 26 and parityregulations (the need to cover mental health on a par with physical health), is creating pressure to find appropriate programs for individuals with SMI – a disease that onsets typically between ages 16-22, paving the way for the ideas below.

What can be done?

I am pursuing several tactics to ensure that commerical insurance companies provide the necessary coverage and benefits

- In Illinois in 2019, legislation was passed that mandated insurance coverage for CSC and PACT. Taking inspiration from that, I worked with legislators in Massachusetts and like-minded colleagues to draft similar legislation for Massachusetts. The bills call for reimbursement as a bundled rate (pays for all the services per member/per month) so that all components of the program(s) are covered. Those bills did extraordinarily well for a first file – reported out favorably from two committees. Time ran out on the session and the bill did not pass. These bills have been refiled in Jan 2023 and been strengthened – they now include penalties for non-compliance with implementation 18 months after passage.

Legislation filed and testimony information

193rd General Court (2023-24)

S873 / H2334 An Act for supportive care for serious mental illness

Sponsors: Sen Cronin, Rep Decker

Requires health insurers to cover Coordinated Specialty Care and Assertive Community Treatment as a benefit reducing the overall cost burden on insurers, while having a much better outcome for the individual, addressing barriers to accessing care

192nd General Court (2021-22)

S.646/H.1062Joint Committee on Financial Services hearing completed, watch the replay.

- MAPNet is a technical assistance group supporting the teams spinning up Coordinated Specialty Care programs in Massachusetts. We are working with a consultant to devise a method to negotiate for a bundled rate with both MassHealth (our Medicaid insurance payer) and commercial insurers.

- Most large insurers (like companies I have worked for) are self insured plans. That means the large company is actually carrying the risk for claims. These programs are usually managed by names that are familiar to us, like Blue Cross Blue Shield, but they are actually known as “Third Party Administrators” (TPA). It can be really hard to tell what kind of plan you may have, but if you work for a big company, it’s likely you’re in a self-insured plan. Companies like that can set their own benefits packages. While they do take advice from their TPA, they can, for instance, decide to cover CSC and/or PACT. I have gathered research that demonstrates that there is a decrease in productivity for employees providing caregiving to someone with psychosis that is 2x the impact for all types of caregiving (elderly parent, child with a disability, etc.). Since the folks with psychosis are actually a small percentage of the overall population, there is small risk of a large number of claims to any one company. And since the impact on their employee’s productivity is substantial, it is in their best interest to cover these programs in their mental health benefits packages. At this point in time, none of them do!

- According to the national experts, not paying for CSC is a parity violation. I am also pursuing this angle. That does require finding someone, with commercial insurance, who is paying for some portion of their CSC care out of pocket and that their provider would be able to seek reimbursement for those costs by billing on a bundled team rate. In that case, it is expected that the insurance company will deny that payment, and we would pursue an appeal based on the parity violation.